Disposable Income Cost . We minimise your costswe keep things simple It is also known as disposable. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. We minimise your costswe keep things simple disposable income, also known as disposable personal income (dpi) or net pay, is the. Disposable income (disposable earning) in. disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. for most people, disposable income is the money used to pay everyday living costs, so it's important to. disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or.

from cy.ons.gov.uk

for most people, disposable income is the money used to pay everyday living costs, so it's important to. We minimise your costswe keep things simple disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. Disposable income (disposable earning) in. It is also known as disposable. disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. disposable income, also known as disposable personal income (dpi) or net pay, is the. We minimise your costswe keep things simple

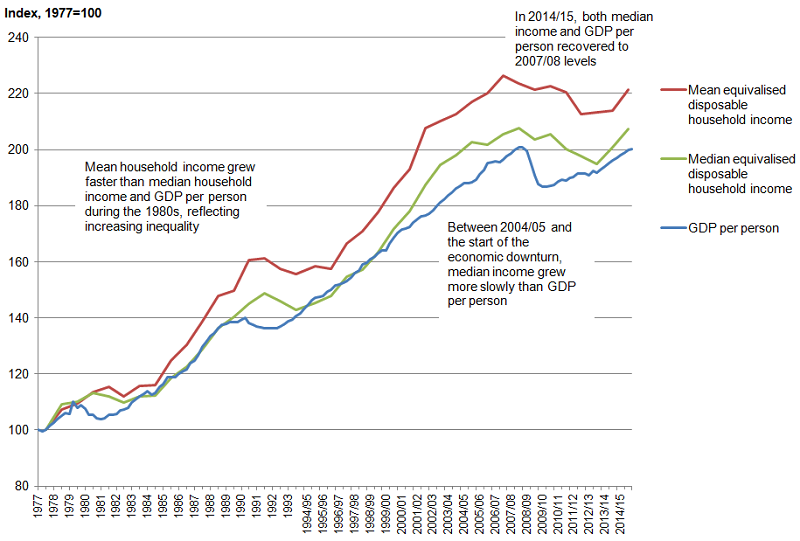

Household disposable and inequality Office for National Statistics

Disposable Income Cost disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. We minimise your costswe keep things simple Disposable income (disposable earning) in. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. It is also known as disposable. disposable income, also known as disposable personal income (dpi) or net pay, is the. We minimise your costswe keep things simple for most people, disposable income is the money used to pay everyday living costs, so it's important to.

From www.researchgate.net

Disposable and consumer spending Download Scientific Diagram Disposable Income Cost Disposable income (disposable earning) in. It is also known as disposable. disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. We minimise your costswe keep things simple. Disposable Income Cost.

From wealthproactive.com

What Is Disposable 15 Essential Insights Wealth Proactive Disposable Income Cost We minimise your costswe keep things simple for most people, disposable income is the money used to pay everyday living costs, so it's important to. disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. It is also known as disposable. disposable income, also known as net pay,. Disposable Income Cost.

From skintdad.co.uk

How to increase your disposable Skint Dad Disposable Income Cost Disposable income (disposable earning) in. disposable income, also known as disposable personal income (dpi) or net pay, is the. It is also known as disposable. for most people, disposable income is the money used to pay everyday living costs, so it's important to. disposable income is the money that is available from an individual’s salary after he/she. Disposable Income Cost.

From www.unicus.com

Disposable increased by 75 Unicus Disposable Income Cost for most people, disposable income is the money used to pay everyday living costs, so it's important to. disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. We minimise your costswe keep things simple Disposable income (disposable earning) in. disposable income, often defined as disposable personal. Disposable Income Cost.

From endel.afphila.com

Disposable Overview, Formula, Significance Disposable Income Cost if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. We minimise your costswe keep things simple for most people, disposable income is the money used to pay everyday living costs, so it's important to. disposable income, also known as net pay, refers to the income that’s. Disposable Income Cost.

From unioncapital.us

What Is Disposable Definition & Importance in Personal Finance Disposable Income Cost disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. We minimise your costswe keep things simple disposable income is the money that is available from an individual’s. Disposable Income Cost.

From www.brightwoodventures.com

Chart of the Day Disposable Shock to the System Brightwood Disposable Income Cost disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. disposable income, also known as disposable personal income (dpi) or net pay, is the. disposable income, also. Disposable Income Cost.

From www.awesomefintech.com

Disposable AwesomeFinTech Blog Disposable Income Cost if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. We minimise your costswe keep things simple disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. Disposable income (disposable earning) in. for most people, disposable income is the. Disposable Income Cost.

From seekingalpha.com

Disposable per Capita Spending More With Fewer Real Dollars Disposable Income Cost disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. We minimise your costswe keep things simple disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. if you earn $1,500 every two weeks, and your employer deducts. Disposable Income Cost.

From www.ons.gov.uk

Measuring Real Household Disposable Office for National Statistics Disposable Income Cost disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. It is also known as disposable. disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. disposable income, also known as disposable personal income (dpi) or net pay,. Disposable Income Cost.

From londonist.com

High Wages But High Rent Is London Worth The TradeOff? Londonist Disposable Income Cost Disposable income (disposable earning) in. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. It is also known as disposable. disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. disposable income, often defined as disposable. Disposable Income Cost.

From www.educba.com

What is Disposable Formula Types And Examples Advantages Disposable Income Cost for most people, disposable income is the money used to pay everyday living costs, so it's important to. Disposable income (disposable earning) in. disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. We minimise your costswe keep things simple disposable income, often defined as disposable personal income (dpi),. Disposable Income Cost.

From savvyroo.com

US spending on basics a as share of disposable SavvyRoo Disposable Income Cost Disposable income (disposable earning) in. disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. disposable income, also known as disposable personal income (dpi) or net pay, is the. disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. We. Disposable Income Cost.

From news.cgtn.com

What is the per capita disposable in China? CGTN Disposable Income Cost It is also known as disposable. disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. We minimise your costswe keep things simple if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. disposable income is the money. Disposable Income Cost.

From www.worldfinance.com

Global review a look at average monthly disposable World Finance Disposable Income Cost It is also known as disposable. disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. for most people, disposable income is the money used to pay everyday living. Disposable Income Cost.

From www.gobankingrates.com

What is Disposable Understand and Better Plan Your Finances Disposable Income Cost if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. for most people, disposable income is the money used to pay everyday living costs, so it's important to. disposable income, also known as net pay, refers to the income that’s left for personal spending after direct. We. Disposable Income Cost.

From www.researchgate.net

Disposable and consumer spending Download Scientific Diagram Disposable Income Cost disposable income, often defined as disposable personal income (dpi), is the sum of money available to an individual or. for most people, disposable income is the money used to pay everyday living costs, so it's important to. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270.. Disposable Income Cost.

From www.researchgate.net

8 Components of disposable by equivalized disposable Disposable Income Cost disposable income is the money that is available from an individual’s salary after he/she pays local, state, and federal taxes. disposable income, also known as disposable personal income (dpi) or net pay, is the. if you earn $1,500 every two weeks, and your employer deducts $230 for taxes, your disposable income would be $1,270. disposable income,. Disposable Income Cost.